Everything about Mortgage Broker

Wiki Article

Get This Report about Mortgage Broker Salary

Table of ContentsFascination About Mortgage Broker MeaningTop Guidelines Of Mortgage Broker Job DescriptionGetting My Mortgage Broker Salary To WorkThe Single Strategy To Use For Mortgage Broker AssistantThings about Broker Mortgage CalculatorExcitement About Mortgage Broker MeaningThe Basic Principles Of Mortgage Broker Average Salary Some Known Details About Broker Mortgage Rates

What Is a Mortgage Broker? A home mortgage broker is an intermediary in between an economic establishment that provides car loans that are protected with property as well as people thinking about acquiring real estate that need to obtain money in the form of a financing to do so. The home loan broker will deal with both celebrations to obtain the individual approved for the loan.A home loan broker normally functions with various lenders as well as can use a variety of car loan choices to the customer they function with. What Does a Home loan Broker Do? A home loan broker aims to complete realty purchases as a third-party intermediary between a customer as well as a loan provider. The broker will collect details from the private and also most likely to numerous loan providers in order to find the best prospective lending for their client.

The 7-Second Trick For Mortgage Broker Meaning

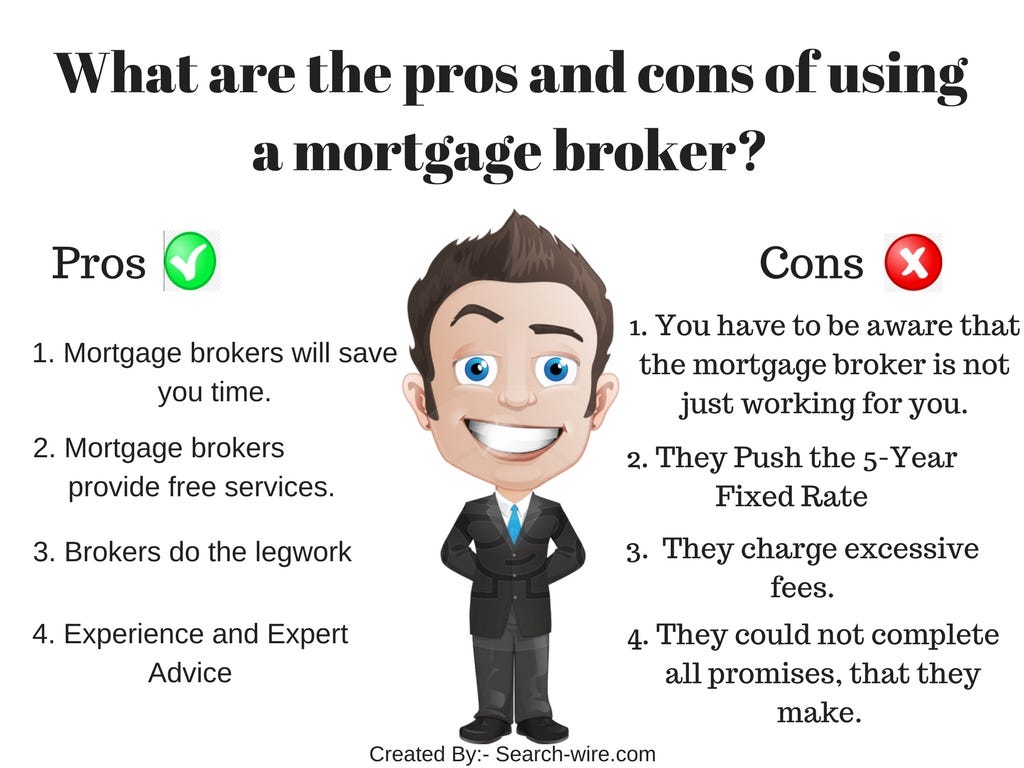

The Base Line: Do I Need A Home Loan Broker? Dealing with a mortgage broker can save the debtor time and also effort during the application process, and also possibly a great deal of cash over the life of the lending. In enhancement, some loan providers function specifically with home mortgage brokers, indicating that consumers would certainly have access to car loans that would certainly otherwise not be readily available to them.It's essential to take a look at all the fees, both those you may need to pay the broker, along with any charges the broker can assist you prevent, when considering the decision to collaborate with a mortgage broker.

The Broker Mortgage Rates Statements

You have actually probably heard the term "mortgage broker" from your property agent or pals that have actually bought a house. What specifically is a home loan broker and what does one do that's various from, say, a loan policeman at a financial institution? Geek, Budget Overview to COVID-19Get response to questions about your home mortgage, travel, financial resources and also preserving your satisfaction.1. What is a home loan broker? A home mortgage broker serves as an intermediary in between you as well as potential lending institutions. The broker's job is to contrast home mortgage lending institutions in your place and also locate rate of interest that fit your requirements - broker mortgage rates. Home mortgage brokers have stables of lending institutions they collaborate with, which can make your life simpler.

How Mortgage Brokerage can Save You Time, Stress, and Money.

Exactly how does a mortgage broker make money? Home loan brokers are usually paid by lending institutions, sometimes by consumers, but, by law, never both. That regulation the Dodd-Frank Act Restricts home loan brokers from billing hidden fees or basing their compensation on a consumer's rate of interest price. You can likewise pick to pay the home mortgage broker yourself.The competitiveness and also home costs in your market will have a hand in determining what mortgage brokers cost. Federal law restricts just how high compensation can go. 3. What makes home loan brokers various from car loan police officers? Financing policemans are employees of one loan provider who are paid set incomes (plus perks). Loan officers can compose only the sorts of finances their company picks to offer.

4 Easy Facts About Mortgage Broker Meaning Shown

Home mortgage brokers might be able to give consumers accessibility to a wide option of loan kinds. You can conserve time by utilizing a home loan broker; it can take hrs to apply for preapproval with various loan providers, then there's the back-and-forth communication entailed in underwriting the funding and also ensuring the transaction remains on track.Yet when selecting any kind of lender whether through a broker or straight you'll wish to take notice of lender fees. Especially, ask what fees will appear on Page 2 of your Financing Price quote kind in the Financing Expenses area under "A: Origination Charges." Then, take the Car loan Estimate you obtain from each loan provider, place them alongside and also contrast your passion rate and all of the costs and shutting prices.

Rumored Buzz on Mortgage Broker Average Salary

Exactly how do see it here I choose a home loan broker? The ideal means is to ask friends and family members for recommendations, however make sure i thought about this they have really used the broker and also aren't just going down the name of a previous university roommate or a remote colleague.

Examine This Report on Mortgage Brokerage

Competition and also house prices will affect exactly how much mortgage brokers get paid. What's the distinction in between a home loan broker and a funding policeman? Loan officers function for one lender.

The Single Strategy To Use For Mortgage Broker Vs Loan Officer

Getting a new residence is visit their website among the most intricate occasions in an individual's life. Properties differ significantly in regards to style, features, school district and also, naturally, the always important "area, location, place." The home mortgage application procedure is a challenging facet of the homebuying procedure, especially for those without previous experience.

Can establish which concerns may produce troubles with one lender versus one more. Why some purchasers stay clear of home mortgage brokers Occasionally property buyers feel extra comfortable going directly to a big bank to safeguard their lending. In that instance, customers need to at least talk with a broker in order to understand all of their options concerning the kind of car loan as well as the offered price.

Report this wiki page